Krones Group Annual Report 2023

“Krones is very well positioned in a steadily growing market. With its new target picture, “Solutions beyond tomorrow”, Krones has mapped out its path to a successful and sustainable future.”, Christoph Klenk, CEO

Strategy and management system

In 2022, on the basis of its technology leadership and customer requirements, Krones developed a new, ambitious target picture: “Solutions beyond tomorrow”. Even though we are still at the early stages and have a long way to go, we are already seeing the successes of our activities aligned to the new target picture.

Through all the changes that we aim for as a company, or that arise as a result of high economic volatility, we benefit from the enormous flexibility and motivation of the entire workforce. In the past year, the Krones team once again faced some tough challenges. One of these consisted of processing the extremely high 2022 order intake on time and in our usual high quality, despite the ongoing tight supply of materials in 2023. We achieved this thanks to the great commitment of our employees – as shown by the very good business figures for the 2023 financial year.

Stable demand from attractive markets

We benefit from attractive sales markets in the beverage and liquid food industry. Demand for packaged beverages and foods is growing steadily. This is driven by megatrends such as global population growth, a growing middle class in emerging markets and continuously increasing urbanisation, especially in the Global South. The two focal areas of sustainability and digitalisation also ensure high levels of demand for the long term. As an internationally leading supplier of beverage filling and packaging technology, Krones is exceptionally well positioned to capitalise on market opportunities with its comprehensive global product and service portfolio.

However, despite our good business results, improved material supply and sustained high demand for our products and services, we remain vigilant about both short and long-term risks. Conflicts such as those in Ukraine and the Middle East have multiplied significantly in recent times. Tensions between the USA and China could also cause substantial shifts in the global order and -reverse the globalisation of the world economy in the medium and long term. Climate change, the availability of natural resources and digitalisation are long-term risk factors faced by nearly all companies. However, sustainability and digitalisation also present huge business opportunities for Krones.

More flexibility and resilience through enhanced cost structure

Growth is an important condition for the continued future success of Krones. But it has to be profitable growth. One of our core strategic imperatives is therefore to continually enhance Krones’ cost base and organisational structure. To this end, we are implementing cost-cutting programmes in almost all areas. In parallel, we are accelerating and digitalising our internal processes and workflows.

The expansion of our global value chain also contributes significantly to improving cost structures. By broadening and building more redundancy into Krones’ global procurement and production footprint, we enhance our ability to respond flexibly to diverse crisis scenarios, such as protectionist measures, regional supply chain problems or production stoppages. The company has gained significant cost advantages in recent years by establishing production facilities and associated supply chains in Hungary and China. In the coming years, we intend to progressively increase the proportion of value added generated internationally by the Krones Group.

The company’s aim is to reduce fixed costs as a percentage of total costs. This will enable us to respond even more flexibly in today’s more volatile economic environment and further enhance our resilience in times of crisis.

Maintaining adequate sales prices

Sales prices are a key factor in Krones’ profitability. By delivering innovative solutions and reliably completing projects for our international customers, we have successfully adjusted our sales prices to meet increased cost levels over the past two years. Although competition remains intense, we will stick to our pricing strategy and pass on rising material and labour costs. The substantial order backlog allows us to uphold our price discipline even in the face of any downturn in demand.

Innovations as the cornerstone of Krones’ long-term success

High-quality, innovative products and services are also fundamental to maintaining high price quality. They must provide significant and measurable added value to customers and help them achieve their goals. Our regular contact with customers and collaboration with them on solution development ensure that we have the best possible understanding of their needs. Aligned with our new target picture, “Solutions beyond tomorrow”, Krones’ focus in innovation is on sustainability, digitalisation and system solutions.

Solutions beyond tomorrow – for a sustainable and successful future

The focal points of “Solutions beyond tomorrow” are three key challenges confronting humanity: Combating climate change, feeding the world, and ensuring responsible use of packaging materials. The new target picture we have derived from these provides the basis for the company’s strategic orientation. Our strategic focus here is on the core areas of sustainability, service quality and digitalisation. These three areas also determine the strategic orientation of our three segments.

Sustainability: priority issue for customers and Krones

Sustainable products will be the main innovation and growth driver in the next decade. We are seeing a strong rise in demand from our customers for machines, systems, lines and entire beverage plants that save valuable resources and reduce carbon emissions. By enabling customers to produce foods and beverages with high levels of resource efficiency and recycling, Krones helps them achieve their sustainability goals.

Our goal: contributing to a climate-friendly industry

Krones has committed to making a significant contribution to combating climate change and conserving resources. We published details on the implementation of our climate strategy for the first time in mid-2023, in our Public Carbon Transition Plan. In this document, which will be updated annually, the Group sets out its targets, measures, progress and additional implementation plans for achieving its climate goals.

Beyond optimising our own processes, it is imperative for us to devise and implement sustainable solutions for our customers in the food and beverage industry. Through the TÜV-certified, dynamically evolving enviro sustainability program, Krones provides customers with optimum support in achieving their ambitious climate targets. The energy and media-efficient product range verifiably and measurably saves customers valuable resources in the operation of our machines and lines. Our customers have long benefited from the lower energy and resource consumption of enviro products. Additionally, Krones’ sustainability consultants support our customers with an integrated, all-factory approach to measurably reduce their ecological footprint, both for new and existing plants.

Krones has set itself the ambitious goal that, by 2030, the machines and lines we manufacture will save our customers an additional 25% in energy and resources in absolute terms compared to 2019. As Krones has significantly increased unit sales of new machines and lines in the last two years and intends to continue this growth in the future, the savings per machine or line have to significantly exceed the 25% target. While achieving this will take a lot of work, the strong demand for enviro products gives us a major incentive.

The company aims for an 80% reduction in its operational greenhouse gas emissions (Scope 1 and Scope 2) and a 25% reduction in value chain emissions (Scope 3) by 2030 relative to 2019. We stand at around a 50% reduction in Scope 1 and Scope 2 at the end of the 2023 financial year and are also seeing positive effects for Scope 3 from supply chain and product-related savings. At the beginning of 2024, we supplemented our climate strategy to include a net-zero emissions target by 2040.

Closing the loop to reduce emissions and plastic

If we are to solve the problem of plastic waste on our planet, we need to move away from single-use plastics and towards a circular economy. Over the next few years, many beverage producers will significantly increase the amount of recycled PET (rPET) in their bottles in order to significantly reduce their reliance on PET, which is a valuable resource. Krones will support its customers here from material-saving packaging design, preform production (injection moulding) and bottle production (stretch blow moulding) through filling, labelling and packaging to the recycling of used plastic bottles and their reuse in the food and beverage industry. In February 2024, we signed the contract to acquire Netstal, a Swiss injection moulding technology company. We expect the transaction to be finally closed in the first half of 2024. Once the transaction is completed, we will have closed the recycling loop in terms of plastic and will have all of the main products needed to turn used PET bottles into new containers for bottling beverages.

Krones recycling technology can also be used to recycle other high-quality packaging plastics (HDPE, LDPE, PP and PS). With bottle-to-bottle recycling, we contribute significantly to preventing the loss of plastic as a valuable resource and to curtailing plastic waste. To further harness the potential of our recycling technology, our plan is to carve out this business area as a standalone entity in 2024. We have already successfully completed a carve-out of this kind with our brewery activities.

Tackling climate change and sustainably feeding the world with alternative proteins

One of the three major global challenges that Krones is addressing together with its customers is feeding the world in a way that is sustainable and climate-friendly. The mass consumption of animal protein in industrialised countries especially generates enormous greenhouse gas emissions. A solution to this problem lies in the production of high-quality vegetable proteins as an alternative to animal protein.

Krones plans to play a major role in this market, which will continue growing in the medium to long term – analysts expect growth of 15% a year up to 2030. The market for plant-based dairy alternatives (based on soy, oats, nuts, etc.) is already established. Leveraging its extensive expertise in dairy production, Krones supports producers here with a complete range of process technology. In the production of solid plant-based proteins, the company draws on decades of experience in fermentation. Krones is thus well positioned in the important growth market for alternative proteins.

Digitalisation helps save resources and provides the basis for new business models

Beverage plants are undergoing a profound digital transformation. To stay competitive, beverage producers have to optimise their systems for efficiency. Digitalisation is a decisive factor here. Krones recognised this trend very early on and has already been supplying digital-ready machines and lines for some years. When it comes to the digitalisation of beverage plants, we benefit from our line and factory expertise – our knowledge of how numerous individual machines and lines seamlessly integrate into a unified whole.

Within the Krones Group, approximately 1,500 people are dedicated to digitalisation initiatives. At Krones.digital, a unit established in 2022, around 500 software and IT engineers work exclusively on the development of digital products and services. By 2025, we plan to expand the digitalisation unit to nearly 700 specialists.

Digital products and services must create added value for customers, either through enhanced product safety, more reliable production or reduced operating costs. The company has combined all digital services in a single browser-based online portal, Krones.world. This gives plant operators access to all digital services. Krones’ goal is to provide digital support throughout the entire life cycle of a machine or line. The company thus intends to evolve more and more from a machine and line manufacturer to a service provider – from “Built by Krones” to “Managed by Krones”. Krones provides plant operators with agreed services that measurably improve plant efficiency. In return, the company is paid a set fee.

Digitalisation is also changing numerous products and processes from within. Krones improves and accelerates such developments with digital tools, including artificial intelligence (AI). Among other things, our team has developed an AI-based solution that significantly streamlines the quotation preparation process for our sales force, translating into significant time savings for both customers and Krones.

Global reach and localised service excellence with some 3,000 service staff worldwide

Looking after the delivery of digital and other services is the job of our approximately 3,000 local service staff in over 70 countries around the world. This enables us to respond quickly and directly to customer needs – a key factor in long-term customer satisfaction. Customers benefit from highly trained service employees with considerable system and line expertise.

Our strategically well-located LCS centres around the globe enable the swift supply of spare parts to plant operators worldwide. A long-term growth driver for the attractive LCS business is our growing installed base. We also intend to further increase the proportion of Krones-supplied managed lines.

Growth through further internationalisation

In order to meet the growing demand for service, Krones will continue to invest in the expansion of the sales and service organisation and further increase the size of the service team. The focus here is on international markets, where growth rates will remain above average. Krones will continue to invest heavily in sites in such markets and recruit local talent. In particular, the Asia-Pacific region and Africa are expected to see the strongest growth over the long term. In the reporting period, the company once again increased the size of its workforce in the regions shown in the table by 792 to 6,457 employees.

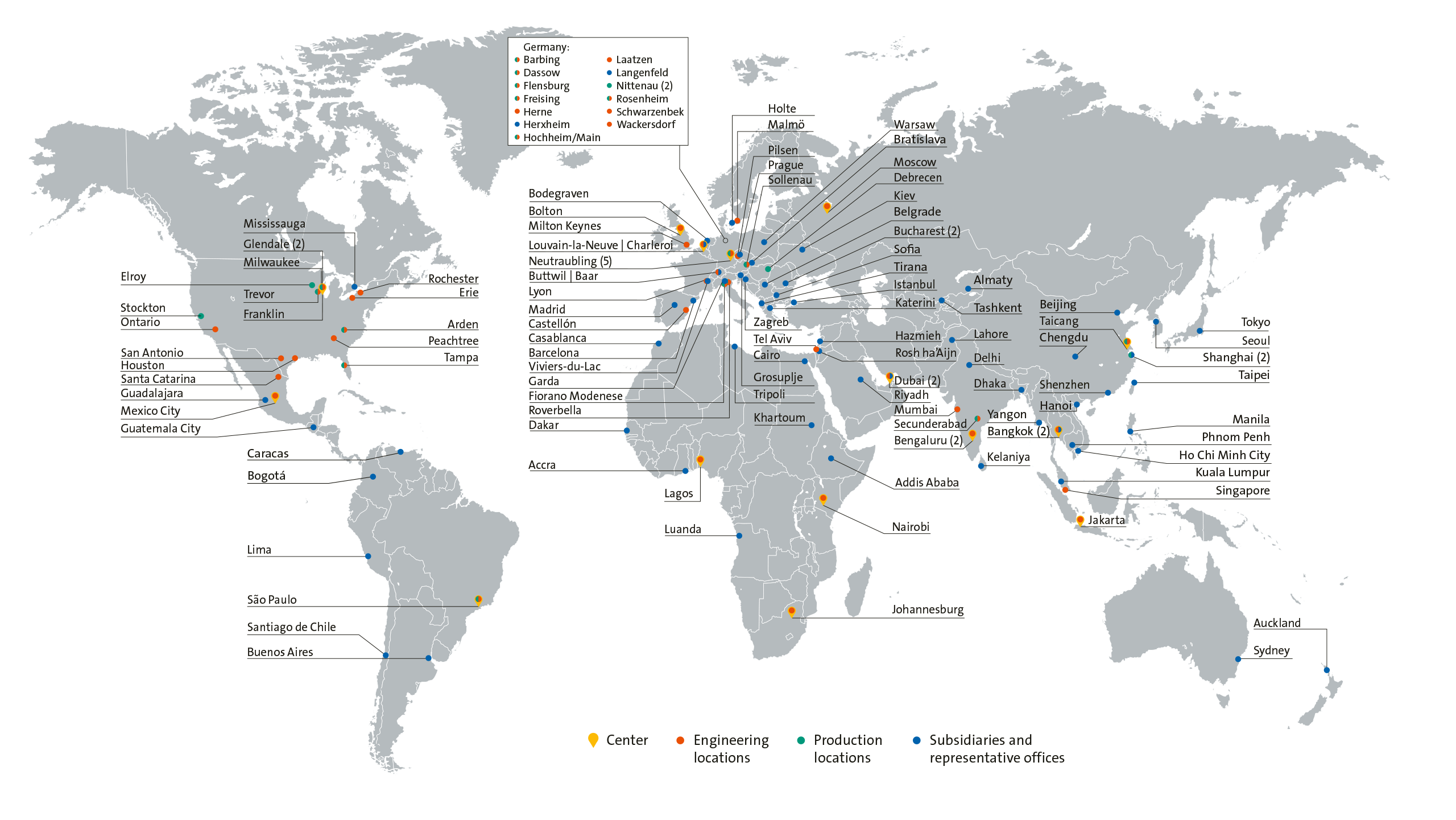

Krones Global Footprint

Strategic focus in the segments

Filling and Packaging Technology: Continued very strong demand for PET; cans and aseptics support growth

Beverage packaging made of PET continues to be highly popular, both with our customers and with consumers. Demand for PET lines remains stable at a high level. The reasons speak for themselves. PET bottles are light and easy to handle, but also sturdy and hard-wearing. This packaging material also has a relatively small carbon footprint and is comparatively inexpensive to produce, which positively affects the selling price of the end products. Our PET lines thus enable the production of sustainable and affordable beverages – in line with our target picture. We aim to consolidate and extend our leading position in PET lines with even better performance and lower resource consumption.

If PET is to remain the most popular packaging material for beverages in the long term, the majority of PET bottles in the future must be made of recycled PET. Krones is well positioned here to support customers with its recycling lines. In addition, we already have numerous lines in operation at customers that can readily process rPET, which has slightly different properties from virgin PET.

The market for aseptic filling in PET containers also presents good growth opportunities for the core segment. Demand is likely to remain strong in the USA especially, where the standard up to now has been the hotfill process – aseptic filling under heat with high energy consumption. US beverage producers are increasingly transitioning from this process to technologically advanced and sustainable aseptic lines. These significantly reduce the carbon footprint and plastic usage.

Krones picked up on the trend towards metal cans several years ago and is now the global market leader in the canning of beer and soft drinks. Aluminium beverage cans are the most recycled form of beverage packaging in the world and are almost infinitely recyclable without any loss of quality. This means they make a key contribution to resource conservation. Krones aims to strengthen its position in canning lines with flexible, hygienic, space-saving and resource- efficient solutions.

Process Technology

Energy-efficient solutions and alternative proteins are markets of the future

The transformation of the Process Technology segment begun in previous years is well underway. Technologies for the production of plant proteins and energy-efficient solutions for beverage production continue to gain in importance. Demand for both technologies will grow at above-average rates in the medium to long term, driven by their potential to reduce global carbon emissions. We also plan to expand the LCS and components business in this segment. Both of these areas will help drive revenue and earnings growth in Process Technology. The acquisition of US pump manufacturer Ampco Pumps in the second quarter of 2023 completed our pump portfolio, strengthening our components business and expanding our sales potential in the US market.

Intralogistics

Market with potential

In addition to the dynamic growth of the logistics market, the Intralogistics segment is also benefiting from the sustainability megatrend. Customers still frequently underestimate the potential in intralogistics. Solutions from our subsidiary System Logistics can yield up to 40% energy savings and up to 20% lower operating costs. Our automated solutions also free up logistics staff and reduce the number of operators required – a major gain in terms of added value for customers in times of labour shortages.

In the medium term, Krones intends to further internationalise its intralogistics business and extend it to customer groups outside the beverage and liquid-food market. Increased revenue shares from automated picking systems and autonomous mobile robots, coupled with an expanded service business, will further enhance the segment’s profitability.

Financial position ensures resilience and enables future investment

As a result of the good business performance, Krones continued to maintain its capital and financial resources at a very high level in the reporting period. At the end of 2023, Krones had a very solid equity ratio of 38.3% and a net cash position of €445 million. In addition, the company has around €850 million in undrawn credit lines. This strong financial and capital structure gives the company and its employees the stability and security they need in today’s unpredictable political and economic landscape. Its comfortable capital base also enables Krones to make strategic investments in growth and the future from internal resources.

The executive board will continue to invest some 5% of revenue in research and development. In addition, the company plans to commit between 2.5% and 3.5% of revenue in the coming years to capital expenditure on capital assets. This expenditure will mainly go on optimizing processes, production structures and IT systems. Internal sustainability projects (Scopes 1 and 2) will continue to account for a notable proportion of capital expenditure.

Acquisitions are and will remain part of Krones’ growth strategy. When identifying potential acquisitions, we focus on medium-sized, profitable companies that complement the existing portfolio technologically and regionally or provide access to markets beyond the beverage and liquid food industry. Examples include the filling and packaging of food, pharmaceuticals and cosmetics. We have continued to implement our acquisition strategy in the reporting period and also in the current year. With the acquisition of US-based Ampco Pumps in the second quarter of 2023, we expanded our components business in Process Technology to include high-quality pumps and significantly improved our access to the US market. Following the final closing of the acquisition of Netstal, the Swiss injection moulding technology company, which is planned for the first half of 2024, Krones will be able to offer its customers all important machines, lines and services for the complete PET packaging cycle. Netstal also underpins Krones’ strategy of extending the customer focus to the medical/pharmaceutical, cosmetics and food industries.

Krones remains committed to sharing its success with shareholders through dividends. The company’s dividend strategy is to distribute an amount of 25% to 30% of consolidated net income to shareholders, although in recent years it has aimed for the upper end of this range.

Improving free cash flow and ROCE, optimising working capital

Key financial performance indicators for Krones alongside revenue and earnings are free cash flow and return on capital employed (ROCE). To achieve our ROCE target of at least 20% by 2025 (2023: 16.3%), we will both increase EBIT and, in the medium term, further optimise the allocation of resources in working capital. The company has taken various steps to reduce working capital for this purpose. Reducing working capital has a positive effect on ROCE.

Working capital is also an important determinant of free cash flow. Less working capital tied up in the operating business leaves the company more financial resources for other purposes. After the exceptionally high free cash flow in 2022, free cash flow decreased significantly as expected in the reporting period, mainly due to the strong increase in working capital. Free cash flow is expected to return to normal in 2024 and increase in the medium term.

Krones is very well on track to achieve its medium-term targets by 2025 – in some cases earlier

At the end of 2021, the company adopted ambitious targets for the period up to 2025.

Revenue is targeted to grow organically – without acquisitions – by an average of 5% year on year until 2025. Including acquisitions, the company aims for revenue of at least €5 billion in 2025 (2023: €4.72 billion). Due to the strong increase in revenue in 2022 and 2023 and the large order backlog, Krones expects that it will already achieve this target in the 2024 reporting year.

The company’s commitment to profitable growth is central to its sustainable long-term success. Generating sufficient earnings is essential in order to make the necessary investments in the future and navigate potential crises. In the medium term, the company targets an EBITDA margin of 10–13% (2023: 9.7%). The Executive Board is confident that the measures introduced will enable it to achieve this goal, despite the steeply rising material and labour costs.

Krones aims to increase return on capital employed (ROCE) to at least 20% by 2025 (2023: 16.3%).

Overall, Krones currently sees significantly more opportunities than risks for the achievement of its medium-term goals by 2025.

The Krones team makes the difference: Krones’ most important success factor

The entire Krones team has done an outstanding job over the past few years. Over recent years marked by various challenges, including the coronavirus pandemic, the Ukraine conflict and material shortages, our people have demonstrated their adaptability and flexibility in rapidly changing conditions. Even in difficult times, they consistently delivered our customers’ projects on time, earning trust and confidence. The focus for the current year is on processing orders rapidly and in the usual quality. We are confident that we will meet this challenge to our customers’ satisfaction.

Exceptional team spirit, coupled with the unique expertise, creativity, and unwavering dedication of our employees, underpins Krones’ resilience and success. Ensuring a motivated and qualified workforce remains a priority. Krones will continue to invest in employee training and development, and will strengthen its workforce, particularly in IT, software and service, and also in emerging and developing markets.

Krones’ management primarily uses the following financial performance indicators to steer the group and its three segments:

- Revenue growth

- EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue)

- ROCE – return on capital employed – the ratio of EBIT to average net capital employed in the past four quarters. Net capital employed is defined as non-current assets (excluding goodwill and financial assets) plus working capital.

In order to strengthen our market position and utilise economies of scale, we will continue to generate profitable growth in all three segments in the medium term.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) is a key earnings performance indicator. Profitability, measured as the EBITDA margin (EBITDA as a percentage of revenue) is among our key targets and parameters. The EBITDA margin indicates the company’s profitability in relation to revenue, irrespective of the tax rate, financial income/expense and depreciation and amortisation.

Since the 2022 financial year, our third performance indicator has been ROCE (return on capital employed), calculated at Group level. This is the ratio of EBIT (earnings before interest and taxes) to average net capital employed in the past four quarters. ROCE is a very important profitability indicator for the capital markets. Return on capital employed shows investors how efficiently the company makes use of capital. Until the 2021 financial year, our third key performance indicator was working capital as a percentage of revenue.

Other financial key performance figures

In addition to the above, a further important performance indicator for Krones is free cash flow (cash flow from operating activities less cash flow from investing activities). We take further guidance from the development of EBT (earnings before taxes), the EBT margin (EBT as a percentage of revenue) and the working capital to revenue ratio.

Non-financial performance indicators

In addition to financial performance indicators, non-financial targets are also firmly embedded in Krones’ corporate strategy. These are set out in detail in the non-financial statement. Sustainability is an area of major importance and is also the focus of the Krones target picture.

Key non-financial performance indicators comprise greenhouse gas emissions (Scope 1, Scope 2 and Scope 3), water consumption, hazardous waste, workplace accidents and the share of women in management.

As part of the Krones Group’s sustainability targets, which the Executive Board officially adopted in the 2020 financial year, the company has set ambitious emission reduction targets along the entire value chain.

- We aim for an 80% reduction in our own carbon footprint (Scope 1 and Scope 2) by 2030, relative to the 2019 baseline.

- For Scope 3 emissions – which are much higher and are mainly generated by the operation of our machines and lines at customer sites – we are targeting a reduction of 25% over the same period, again with 2019 as the baseline.

Additional sustainability goals are as follows:

- The Krones Group is committed to a 10% reduction in hazardous waste and water consumption by 2030, with 2020 as the baseline.

- We will reduce both work-related accidents and the resulting lost days per million hours worked by 30% across the Krones Group by 2030, compared to the 2020 baseline.